Financial Adviser Insights, Data to Feb 8, 2024

Adviser Numbers, Net Change of +2, Moving From 15,646 To 15,649

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Join our Members Lounge - Click Here For Membership Information -

First Month at 50% off Extended - Use promo Code 50%Month1

Enter promo code 50%MONTH1 for 50% discount on first month Selecting 'YEARLY' cost is only $950

Summary for the week

The net number change of just +2 may indicate a quiet week. However, 105 advisers were affected by resignations and /or appointments. Two new licensees and three recommenced. Licensees recommencing have been a common theme in 2024.

Key Adviser Movements This Week:

Net change of advisers +2

Current number of advisers at 15,648

Net Change of +36 for Calendar 2024 YTD

Net Change Financial YTD +92

36 Licensee Owners had net gains of 52 advisers

36 Licensee Owners had net losses for (-44) advisers

5 New licensees (3 recommencing) and 3 ceased

11 New entrants.

Number of advisers active this week, appointed / resigned: 105.

Growth This Week - Licensee Owners

A new licensee commenced with 5 advisers. This was a former practice of Hillross, AMP. Details given to our members.

Three licenses owners up by net 3:

Sequoia via its licensee Interprac, with all 3 advisers coming from different licensees

Sambe Investments, with all three from different licensees. Two of the advisers returning after a break

Philborne Pty Ltd (Dirigere Advisory) with the three advisers coming across from Synchron, WT Financial group.

Six licensee owners up by 2 each including:

A new licensee

Adviceiq Partners, with advisers moving across from Fitzpatricks

and Lifestyle Asset Managment with advisers from different licensees

26 licensee owners up by net one each including, Centrepoint, Shaw and Partners and Steinhardt Holding (Infocus).

Losses This Week - Licensee Owners

AMP Group down by a net (-4), after losing (-6) and gaining 2, one being a new entrant.

Insignia down by (-3), losing (-4) and gaining 1. Two of the losses have moved to Infocus.

Ferdinand FFP (Escala) also down by (-3)

Fitzpatricks down by (-2), losing advisers to Adviceiq as mentioned above.

A long tail of 32 licensee owners down by (-1) each including, Count, Diverger, UniSuper and WT Financial Group

Get To Know Your Superannuation Funds

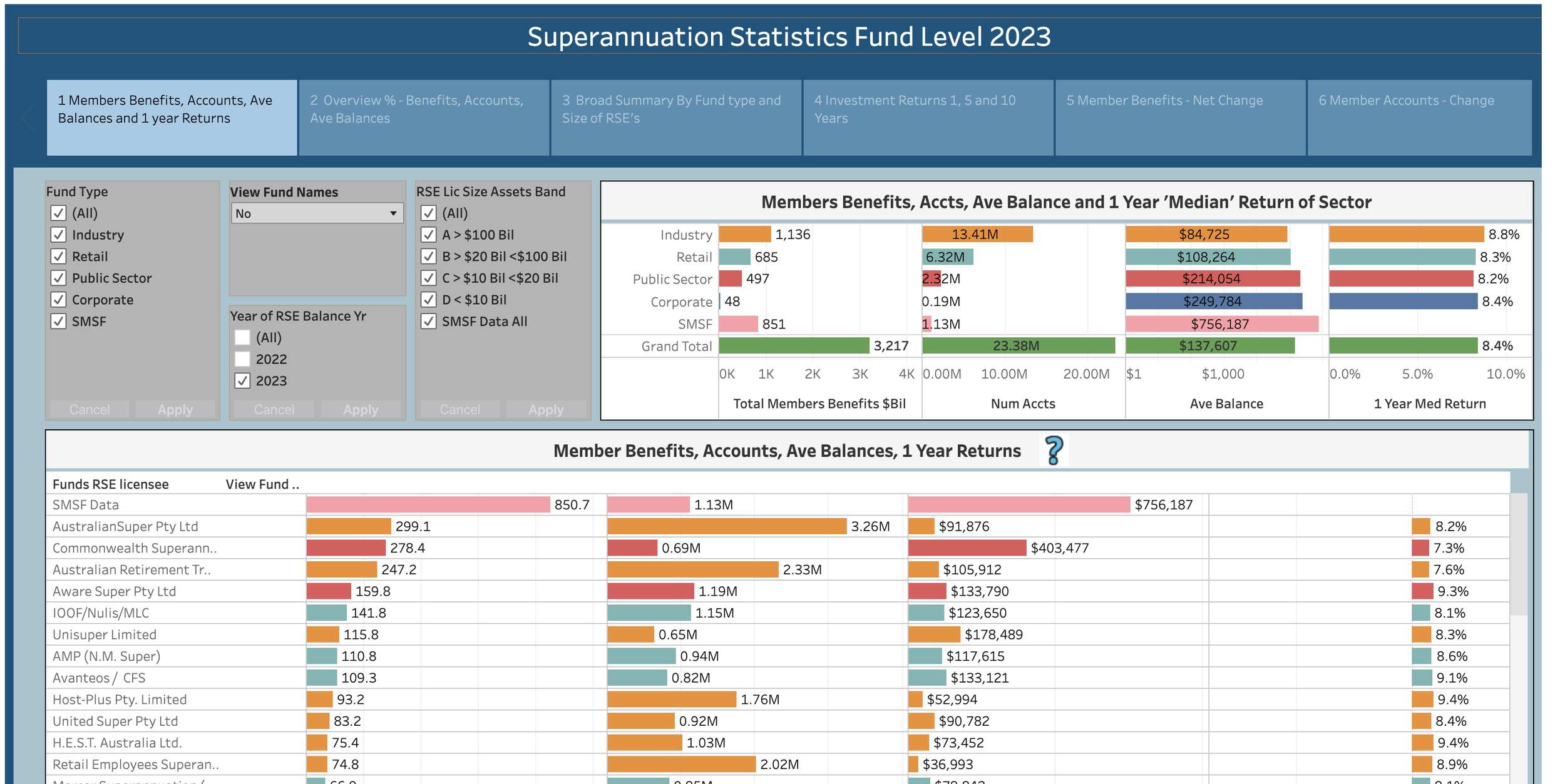

As flagged last week, we have now completed our dashboards covering the key statistics from APRA’s annual fund level superannuation statistics - we have also included SMSF data sourced from the ATO to complete the picture. The dashboards are currently available only to members.

We have extended our ‘First month at 50% off’ - simply use the Promo Code 50%MONTH1 to obtain your discount. Note: You can join and exit without any minimum monthly limits.

The dashboards allow users to filter the funds by fund type, i.e. by Retail, Industry Funds etc, by size of funds, and you can view by the RSE (Registrable Superannuation Entity) holder of the licence and by Fund Names.

Reports cover the market share, size of funds by assets and members, growth, investment allocations, investment returns, costs and much more.

Addition information included in our blog post which includes a short ‘demo’ video - Click To View. The image below is the first dashboard of 12.

Join our Members Lounge for all of your data needs - Click on box