Financial Adviser Insights, Dec 21, 2023

Adviser Numbers This Week, Net Change of (-3) Moving From 15,670 To 15,667

Click Here To Access Basic / Free Adviser Dashboard

Need More Data?

Special Offer As We Launch Our Financial Adviser Client Segmentation Tool

Use Promo Code: 50%MONTH1

A 50% Discount On Your First Month’s Subscription (No Monthly Limits)

Join our Members Lounge - Click Here For Membership Information -

Enter promo code 50%MONTH1 for 50% discount on first month Selecting 'YEARLY' cost is only $950

Please Note: This will be our final update for 2023. We will be retuning mid-January with a round up of all the key metrics for 2023. We anticipate increased market volatility at the end of December, which is a common occurrence. However, many of the adviser movements only make the ASIC Financial Adviser Register (FAR) from mid to late January as everyone returns to work.

This week, net movement was (-3) with 69 advisers affected in some way. There was a jump of 14 new entrants, which is common after the Financial Adviser exam results being released - see more in the post. This also means that some 17 experienced advisers dropped off the ASIC FAR this week.

Key Adviser Movements This Week:

Net change of advisers at (-3)

Current number of advisers at 15,667

Net Change of (-131) for Calendar YTD

Net Change Financial YTD +111

26 Licensee Owners had net gains of 29 advisers

23 Licensee Owners had net losses for (-32) advisers

3 New licensees (one is just a switch) and 1 ceased Note: If you would like to access a list of closed licensees, please contact us.

14 New entrants.

Number of advisers active this week, appointed / resigned: 69.

Growth This Week - Licensee Owners

3 licensee owners up by net 2 each:

Knight Group up by net 2 with 2 new entrants

A new licensee commenced with 2 advisers

Capstone up by 2. However, 1 adviser ceased Capstone one day and was reappointed the next (Admin issue?)

23 licensee owners up by net 1 each including Politis Investments, NTAA, FSSSP (Aware Super) and Findex

Losses This Week - Licensee Owners

Perpetual down by (-4), none showing as being appointed elsewhere

Diverger down by (-3), losing 1 adviser each from Paragem, GPS Wealth and Merit Wealth. One of the advisers moving to Politis, the other 2 not yet appointed elsewhere

Four licensee owners down by (-2) each, including Insignia and AIA Company

17 licensee owners down by (01) each including ASVW Holdings, Clime Group, Fitzpatricks, and Shaw and Partners

Top 10 Growth and Losses Calendar YTD

While we won’t know the final 2023 results until later in January, the tables below highlight the most and least growth YTD. Important to note, the growth numbers do not include growth or losses via the sale of a licensee. We treat a business purchasing a licensee as inheriting the licensee history.

The ‘Net Change’ on a National view shows losses of (-131). Overall very stable compared to the same period last year which was more than 10 times greater at (-1,335).

The licensee owners with most gains are quite modest compared to the losses at a license owner level. Much of this has been driven by advisers leaving larger licensees and commencing their own. A total of 112 new licensees have commenced YTD.

Sequoia Group look like rounding out the year with the most growth ahead of Shaw and Partners, who have had most of their growth over the past few weeks.

Insignia had the greatest losses with WT Financial Group next, who inherited some of Insignia’s losses through the purchase of Millennium 3, who are down (-18).

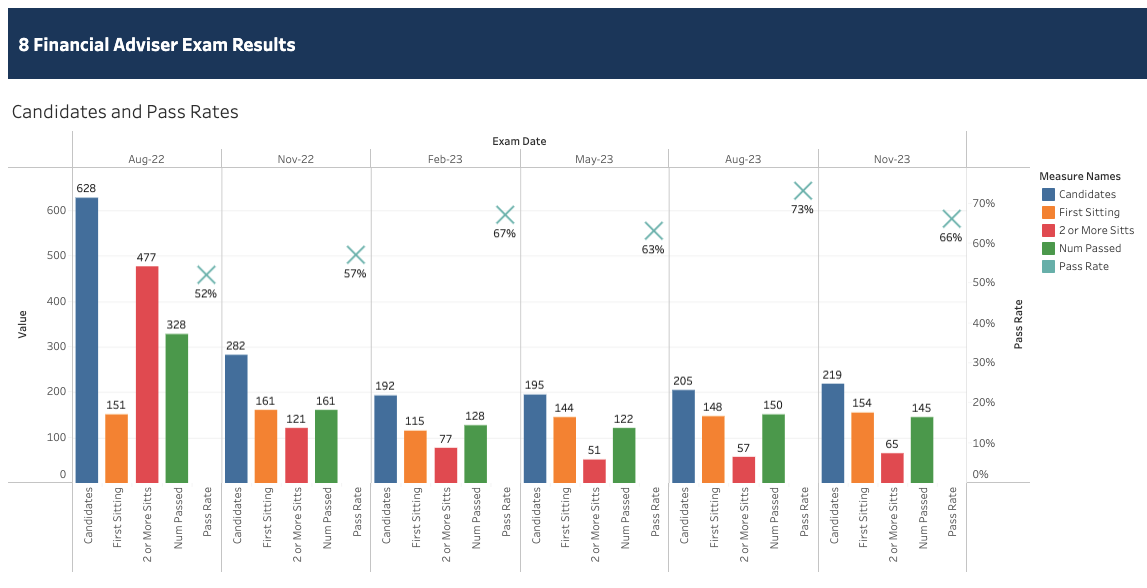

Financial Adviser Exam Results and New Entrants

The results released this week have been reasonably consistent through 2023. As the chart below shows, the number of advisers passing and the pass rate has been relatively similar. Overall, steady growth, but would be nice to see more.

New entrants for 2023 at 383 - that are current on the ASIC FAR. The Financial Planning peer group, hiring 266 which is 2.55% of the current advisers in that group. Accounting - Financial Planning have hired 40 which is 4.44% of their current advisers. The Super Fund peer group have only hired 11 which is 1.54% of their advisers.

New Entrants by Peer Groups Calendar YTD

Financial Adviser Client Segmentation Tool - Update

We recently launched our Financial Adviser Client Segmentation Tool that assists financial advisers to focus on a client base that will work in the current climate. With the announcement from Stephen Jones, Minister For Financial Services, of ‘free advice’ from ‘qualified advisers’, this will ultimately put pressure on current advice firms to fully understand which client segment they should focus on.

The client segmentation tool allows advisers to make data driven decisions to better understand the revenue by segments, impact on their time and breaks revenue to the hour.

We have written a short blog post and updated our demo video. Access is only $42.50 for the client segmentation tool and a lot more. You can join today with 50% discount off the first month by using the promo code 50%MONTH1

Have a great week and checkout the

Members Lounge for all of your data needs - Click on box below

Special Offer Use Promo Code: 50%MONTH1

A 50% Discount On Your First Month’s Subscription (No Monthly Limits)